vat and importing luxury watches Simply multiply the value of the watch in GBP by 20 percent to find the VAT you might have to pay if applicable. Add the basic import duty (step 2) to the VAT (step 3) and you now have the total import duty payable.

Calvin Klein 90s Round Sunglasses. $315 at Calvin Klein. Inspired by the round frames and colored lenses style icons sported on the red carpet and off duty, the capsule is made up of three.

0 · vat on watches reddit

1 · vat on luxury watches uk

2 · tax on watches

3 · pre owned watches vat

4 · customs duty on watches

5 · buy watches in foreign countries

6 · buy watches abroad vat

7 · are watches taxable

$52.99

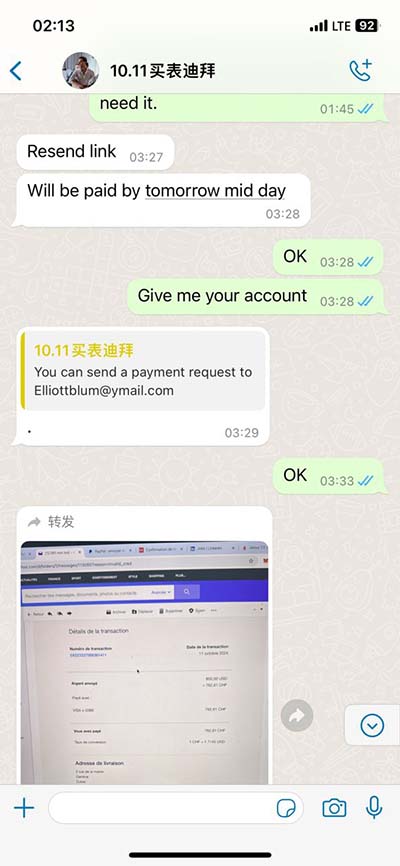

I'll be purchasing a luxury watch while in Europe and bringing it back from Europe to the United States. The total cost will exceed K. I've read about the need to provide my passport at . A foreign watch dealer is required to charge you Value Added Tax (VAT or sales tax) on your watch purchase. After you pay the tax, you can claim it back from the government . Step-by-step guide to importing watches from the USA. Research: Understand the specific type of watch you're importing and its eligibility for import into the UK. . Calculate . UK customers are now expected to pay UK VAT on all imports from the EU. And as for our European brothers and sisters buying watches from me (and anyone else in the UK), they now have to pay their local sales tax (VAT, .

If the item is less than ,000 in value and is not subject to a quota or is not a restricted or prohibited item, a CBP official will usually prepare the paperwork for importing it, .

Simply multiply the value of the watch in GBP by 20 percent to find the VAT you might have to pay if applicable. Add the basic import duty (step 2) to the VAT (step 3) and you now have the total import duty payable.In the UK, luxury watches with a value of over £135 are subject to import duties, which can range from 2.5% to 12%. For example, if you purchase a Rolex watch for £10,000 from Switzerland and import it into the UK, you will have to pay a . UK customers are now expected to pay UK VAT on all imports from the EU. And our European brothers and sisters buying watches from me (and anyone else in the UK), now have to pay their local sales tax (VAT, IVA, . Multiply the basic import duty rate by the watch’s cost in GBP (step 1) and you now have the import duty. Save that number. Compute the import VAT if applicable. UK import VAT is currently 20 percent. Simply multiply the value of the watch in GBP by 20 percent to .

If you were assessed VAT on importing watches into Switzerland or if you purchased goods in the country for which you paid VAT, then you might attempt to receive a refund. . Shopping The Airports For A Luxury Watch: Customs, Duties, And Discounts Explained. . The Luxury Well has been importing watches into the U.S. from all around the globe for over 15 years. In times of global excess inventory, even less seasoned collectors are tempted to make bargain purchases from sellers . Customs duties (including additional ad valorem duties on certain luxury or non-essential items) Anti-dumping and countervailing duties; VAT (which is also collected on goods imported and cleared for home consumption). . To calculate VAT on imported goods, the ATV (added tax value) needs to be determined first. This is done as follows . Or that fancy foreign watch boutique you entered “just to look around.” Don’t do it! Don’t buy a watch abroad. Here’s why . . . [UPDATE: UK VAT Rebate Still Dead – US Watch Buying Discount Down to 11%] “Duty Free” is a hassle A foreign watch dealer is required to charge you Value Added Tax (VAT or sales tax) on your watch .

fossil gen 5 smartwatch price in bangladesh

Importing Watches into Australia. Jump to Latest 40K views 20 replies 13 participants last post by Phrenzy Jan 9, 2013. H. hotmustardsauce Discussion starter 438 posts VAT is charged on the total value of the item which includes the price, insurance, shipping costs and duties. There is no charge on gifts valued at under £135, above that charges depend on the item. . Transferring your payment with your bank could be the most expensive way to pay for your luxury import, because banks often charge a margin of .Calculate import duty and taxes in the web-based calculator. It's fast and free to try and covers over 100 destinations worldwide.

If you were assessed VAT on importing watches into Switzerland or if you purchased goods in the country for which you paid VAT, then you might attempt to receive a refund. . Shopping The Airports For A Luxury Watch: Customs, Duties, And Discounts Explained. Selling Watches To Buy Watches: One Collector’s Story. 2 replies.It is important to note that personal exemptions, tariff classification, applicable rates of duty and taxes and other circumstances that may affect the amount of duties and taxes owed on imported goods are subject to change from time to time, depending on the applicable legislation, regulations and policies.Consumption tax applies to prescribed nonessential and luxury or resource-intensive goods (including alcohol, luxury cosmetics, fuel oil, jewellery, motorcycles, motor vehicles, petrol, yachts, golf products, luxury watches, disposable wood chopsticks, tobacco, certain cell and coating products), and it mainly affects companies involved in producing or importing these .

If the parcel is from outside the EU, you may be charged VAT, customs, or excise duty on it. This also applies to gifts and goods from the EU if they're above a certain value. You'll need to know the tariff or HS code to calculate the exact rate due. If you also need to pay VAT, it'll be charged on the total value of your goods, including .

0:00 Intro0:59 About me1:51 Important notice3:10 Brexit: What happened? And how it affected the UK for buying and selling watches4:19 Import / export Sales T. Example: If the CIF value of the imported goods is USD 20,000, the Import Duty is 5%, and the VAT is 12%. Then the duty/taxes calculation is: Import Duty = 5% * USD 20,000.00 = USD 1000.00For customers in the U.K., all watches/products are priced including 20% of U.K. VAT. As an example, if our watch is priced at £1,000, U.K. customers will need to pay £1,200 (£1,000 + £200 (20% VAT) Prices outside the U.K. For customers based outside the U.K., all watches/products are priced excluding U.K. VAT. Apparently VAT tax was paid as part of original fee. Instagram: Offset_Crown Wrist: 6.75 Rolex Explorer 2 - Tudor Black Bay 58 - Tudor Pelagos FXD Black - Omega Speedmaster Pro Hesi 3861 - 1966 Omega Constellation - Bulova Lunar Pilot - Seiko SKX007. Save Share . How much duty did you pay when importing watch to U.S.?

Hello! I am traveling through Switzerland and was able to purchase one of my grail watches in Luzern. I have been given the paperwork to ensure I do not get charged the VAT tax, which from my understanding will be taken care of at the .Import VAT. Import VAT is a fee currently paid on goods sent to the UK from abroad, but instead of the normal VAT you would pay at the checkout for your items, you’ll pay ‘import VAT’ on the total cost of the item and shipping and handling costs accrued when the courier brings the purchase to the UK. The usual UK Import VAT rate is 20%. If your products are considered luxury goods, they are also subject to Luxury Tax, which rate depends on the type of product. . Total value in IDR x percentage of import duty. VAT (Total value in IDR + Import Duty) x 10%. Income Tax . Watch Marlissa Dessy, the Director of Emerhub, explain the essence of the importer of record service: .

vat on watches reddit

vat on luxury watches uk

Korea has a flat 10 percent Value Added Tax (VAT) on all imports and domestically manufactured goods. A special excise tax of 10-20 percent is also levied on the importation of certain luxury items and durable consumer goods. Tariffs and taxes must be paid in Korean Won within 15 days after goods have cleared Customs. Customs ValuationThe VAT registration threshold for EU VAT-registered companies selling goods over the internet — distance selling — to consumers in Greece is €35,000 per annum. Domestic businesses in Greece must register with the tax authority and get a tax registration number. There are specific rules and regulations that govern the act of importing - and they can be extremely complex and confusing - and costly. . For example, two watches (14-karat gold, 17 jewel), one leather purse. Purchase price in U.S. dollars. Provide both the unit price, and if more than one unit was purchased, the total value for all like items.

Multiply the basic import duty rate by the watch’s cost in GBP (step 1) and you now have the import duty. Save that number. Compute the import VAT if applicable. UK import VAT is currently 20 percent. Simply multiply the value of the watch in GBP by 20 percent to . Need help with importing goods to Germany? Learn the process step-by-step with our guide. From paperwork to customs, we cover everything you need to know to make the process stress-free. . you will be required to pay sales tax (VAT) of 19 percent in addition to varying customs fee on the value of the item. For a more comprehensive list of .

If you are concerned about importing goods for your business, seek advice from the VAT experts from The VAT People. Give us a call on 0161 477 6600, and we will be able to assess your situation and needs, providing you with comprehensive advice in an easy-to-understand way. We recognise that dealing with VAT can be stressful and confusing, so we make it our mission to . Importing watches from China and legal obligations (Customs duty, VAT) When importing watches from China, we must bear in mind the need for Vat and duty. . Description: Mainly a jewellery fair, but with a large section dedicated to luxury watches and clocks. Summary. When importing watches, it is worth paying attention to the necessary .

You’ll then pay the Duty and Import VAT along with the shipping via bank transfer, in one fell swoop before delivery! This facility is included as part of the service (most companies charge an extra fee). When importing samples or smaller consignments via the postal service or a courier company, it’s not dissimilar.

quando escono i nuovi rolex 2024

56mm Square Sunglasses. Saint Laurent. $199.97. (57% off) $475.00. Free shipping on orders $89+ Exclusions apply. An elongated square silhouette add a luxe appeal to these Italian-made sunglasses that are perfect for summer. Color: Havana Havana Brown. Delivery. This item will be shipped via standard shipping. Add to Bag. Add to Wish List.

vat and importing luxury watches|buy watches abroad vat