lvmh pe ratio Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 135.30 +4.34 (+3.31%) . The . 142 likes, 12 comments - globalwonderlandlv on December 26, 2018: "♠️♦️ Our lanterns will a-maze you! ♣️♥️ Visit us now through Jan. 20! #globalwint."

0 · lvmh stock split

1 · lvmh stock price today live

2 · lvmh stock price chart

3 · lvmh share price chart

4 · lvmh pe ratio history

5 · lvmh current ratio

6 · louis vuitton exchange rate today

7 · $lvmh stock

The Lange Shadow 120 LV is a low-volume boot for intermediate to expert skiers looking for a precise fit and awesome performance. The Shadow series replaces the Lange RX series, all we need to say is we won't miss the RX; the Shadow is better on all fronts.

lvmh stock split

Oct 28, 2024 Lvmh Moet Hennessy Louis Vuitton PS Ratio: 3.670 for Oct. 18, 2024. PS Ratio .

alexander mcqueen heroine bag replica

Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 135.30 +4.34 (+3.31%) . The .In depth view into Lvmh Moet Hennessy Louis Vuitton Operating PE Ratio .In depth view into Lvmh Moet Hennessy Louis Vuitton Price to Book Value .

In depth view into Lvmh Moet Hennessy Louis Vuitton Market Cap including .Lvmh Moet Hennessy Louis Vuitton Earnings Yield. Earnings Yield Chart. .

The Price to Earnings Ratio (PE Ratio) is calculated by taking the stock price / .The Price to Earnings Ratio (PE Ratio) is calculated by taking the stock price / .Renault PE Ratio: 7.400 for Oct. 4, 2024. PE Ratio Chart. Historical PE Ratio .

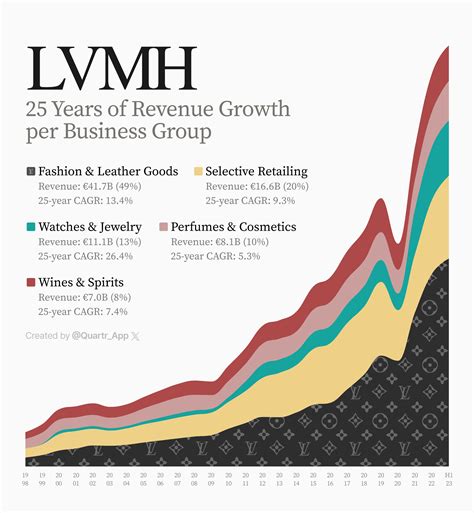

Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 144.68 -4.25 ( -2.85% ) USD | .According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 24.6546. At the end of 2021 the company had a P/E ratio of 29.1 . P/E ratio history for LVMH from 2001 to 2021 The p/e ratio for LVMH Moet Hennessy Louis Vuitton (LVMUY) stock is 22.10 as of Thursday, October 31 2024. It's improved by -8.28% from its 12-month average of 24.10. . LVMH Ratios. Assess the performance of Louis Vuitton (LVMH). This table contains .

PE Ratio (TTM) 21.88 ; EPS (TTM) 27.92 ; Earnings Date Jan 23, 2025 - Jan 27, 2025; Forward Dividend & Yield 13.00 (2.13%) Ex-Dividend Date Dec 2, 2024; 1y Target Est 843.10 What is Lvmh Moet Hennessy Louis Vuitton SE PE Ratio? The PE Ratio, or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company's market price to . Aug 29, 2024 LVMH Moet Hennessy Louis Vuitton's operated at median p/e ratio of 30.2x from fiscal years ending December 2019 to 2023. Looking back at the last 5 years, LVMH Moet Hennessy Louis .

View LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) current and estimated P/E ratio data provided by Seeking Alpha. Pe Ratio (TTM) is a widely used stock evaluation measure. Find the latest Pe Ratio (TTM) for LVMH Moet Hennessy Louis Vuitton (LVMUY) What is Lvmh Moet Hennessy Louis Vuitton SE PE Ratio? The PE Ratio, or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company's market price to its Earnings per Share (Diluted).As of today (2024-10-30), Lvmh Moet Hennessy Louis Vuitton SE's share price is 3.93.Lvmh Moet Hennessy Louis Vuitton SE's Earnings per Share .

Pe Ratio (TTM) is a widely used stock evaluation measure. Find the latest Pe Ratio (TTM) for LVMH Moet Hennessy Louis Vuitton (LVMUY)PE Ratio (TTM) 21.88 ; EPS (TTM) 27.92 ; . LVMH Moët Hennessy - Louis Vuitton, Société Européenne operates as a luxury goods company worldwide. The company offers wines, and spirits under .LVMH Moet Hennessy Louis Vuitton's p/e ratio (fwd) is 22.6x.. View LVMH Moet Hennessy Louis Vuitton SE's P/E Ratio (Fwd) trends, charts, and more. . PE Multiples are widely used in practice even though they have significant pitfalls. Since Earnings Per Share (EPS), . Financial ratios and metrics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (EPA: MC). Includes annual, quarterly and trailing numbers with full history and charts.

LVMH reported 26.67 in PE Price to Earnings for its fiscal semester ending in March of 2024. Data for LVMH | MC - PE Price to Earnings including historical, tables and charts were last updated by Trading Economics this last November in 2024. View LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) current and estimated P/E ratio data provided by Seeking Alpha. . Price/Earnings Ratio. 2023 Actual. 20.50. 2024 Estimated .Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 30.1 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 27.6038.At the end of 2021 the company had a . What is Lvmh Moet Hennessy Louis Vuitton SE PE Ratio? The PE Ratio, or Price-to-Earnings ratio, or P/E Ratio, is a financial ratio used to compare a company's market price to its Earnings per Share (Diluted).As of today (2024-11-02), Lvmh Moet Hennessy Louis Vuitton SE's share price is 9.88.Lvmh Moet Hennessy Louis Vuitton SE's Earnings per Share .

LVMH Moet Hennessy Louis Vuitton's latest twelve months p/e ratio is 24.3x; LVMH Moet Hennessy Louis Vuitton's p/e ratio for fiscal years ending December 2019 to 2023 averaged 33.8x. LVMH Moet Hennessy Louis Vuitton's operated at median p/e ratio of 30.2x from fiscal years ending December 2019 to 2023.In depth view into Lvmh Moet Hennessy Louis Vuitton Operating PE Ratio including historical data from 2008, charts and stats. Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 131.70 -0.89 ( -0.67% ) USD | OTCM | Nov 01, 16:00

LVMH Moët Hennessy - Louis Vuitton Société Européenne's latest twelve months p/e ratio is 26.3x.. View LVMH Moët Hennessy - Louis Vuitton, Société Européenne's P/E Ratio trends, charts, and more. . PE Multiples are widely used in . Detailed annual and quarterly income statement for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY). See many years of revenue, expenses and profits or losses.

LVMH Moet Hennessy Louis Vuitton SE balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View LVMHF financial statements in full. Competitive Comparison of Lvmh Moet Hennessy Louis Vuitton SE's Forward PE Ratio. For the Luxury Goods subindustry, Lvmh Moet Hennessy Louis Vuitton SE's Forward PE Ratio, along with its competitors' market caps and Forward PE Ratio data, can be viewed below: * Competitive companies are chosen from companies within the same industry, with . The p/e ratio for LVMH Moet Hennessy Louis Vuitton (LVMHF) stock is 22.56 as of Wednesday, October 30 2024. It's improved by -6.58% from its 12-month average of 24.15. LVMHF's forward pe ratio is 21.46. The p/e ratio is calculated by taking the latest closing price and dividing it by the diluted eps for the past 12 months.Find out all the key statistics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (MC.PA), including valuation measures, fiscal year financial statistics, trading record, share .

lvmh stock price today live

What is the difference between the current PE ratio and 20 year average for LVMH Moet Hennessy Louis Vuitton SE (LVMHF)? The current price to earnings ratio for LVMHF is -10.50% vs the 20 year average.Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 29.6 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 26.4076.At the end of 2021 the company had a .Detailed statistics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (LVMUY) stock, including valuation metrics, financial numbers, share information and more. . PE Ratio : n/a: Forward PE : n/a: PS Ratio : n/a: PB Ratio : n/a: P/FCF Ratio : n/a: PEG Ratio : n/a: Financial Ratio History. Enterprise Valuation.Lvmh Moet Hennessy Vuitton SE (LVMHF) Nasdaq Listed; Nasdaq 100; Data is currently not available. . Nasdaq provides Price/Earnings Ratio (or PE Ratio) and PEG ratio for stock evaluation .

lvmh stock price chart

A company with a P/E ratio of 40 and a growth rate of 50% would have a PEG ratio of 0.80 (40 / 50 = 0.80). Traditionally, investors would look at the stock with the lower P/E and deem it a bargain.Current and historical P/E ratio charts for LVMH. P/E ratio for LVMH (MC.PA) P/E ratio at the end of 2021: 29.8 According to LVMH's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 27.885.At the . Current and historical daily PE Ratio for Lvmh Moet Hennessy Louis Vuitton SE from 2002 to Oct 28 2024. The price to earnings ratio is calculated by taking the current stock price and dividing it by the most recent trailing twelve-month earnings per share (EPS) number. The data is updated every 20 minutes during market hours.Detailed statistics for LVMH Moët Hennessy - Louis Vuitton, Société Européenne (EPA: MC) stock, including valuation metrics, financial numbers, share information and more. . The trailing PE ratio is 21.87 and the forward PE ratio is 21.17. LVMH Moët Hennessy - Louis Vuitton, Société Européenne's PEG ratio is 11.38. PE Ratio : 21.87 .

fake bum bag

lvmh share price chart

Current and historical daily PE Ratio for Lvmh Moet Hennessy Louis Vuitton SE from 2009 to Sep 13 2024. The price to earnings ratio is calculated by taking the current stock price and dividing it by the most recent trailing twelve-month earnings per share (EPS) number. The data is updated every 20 minutes during market hours. In depth view into Lvmh Moet Hennessy Louis Vuitton PE Ratio (Forward) including historical data from 2008, charts and stats. Lvmh Moet Hennessy Louis Vuitton SE (LVMUY) 136.18 -1.15 ( -0.84% ) USD | OTCM | Oct 29, 16:00

1. Final. 2. Game Recap. Western Pacific Standings. Full Standings. Schedule. Full Schedule. Top Golden Knights News. 2024 NHL Stanley Cup Playoffs bracket. CBS Sports Chris Bengel 5 hrs ago..

lvmh pe ratio|lvmh pe ratio history